How to Make a Budget

Do you want to know how to make a budget?

Are you trying to figure out where you spend all of your money?

Managing your finances can be stressful and difficult to understand, but I am going to break it down to make it super easy for you.

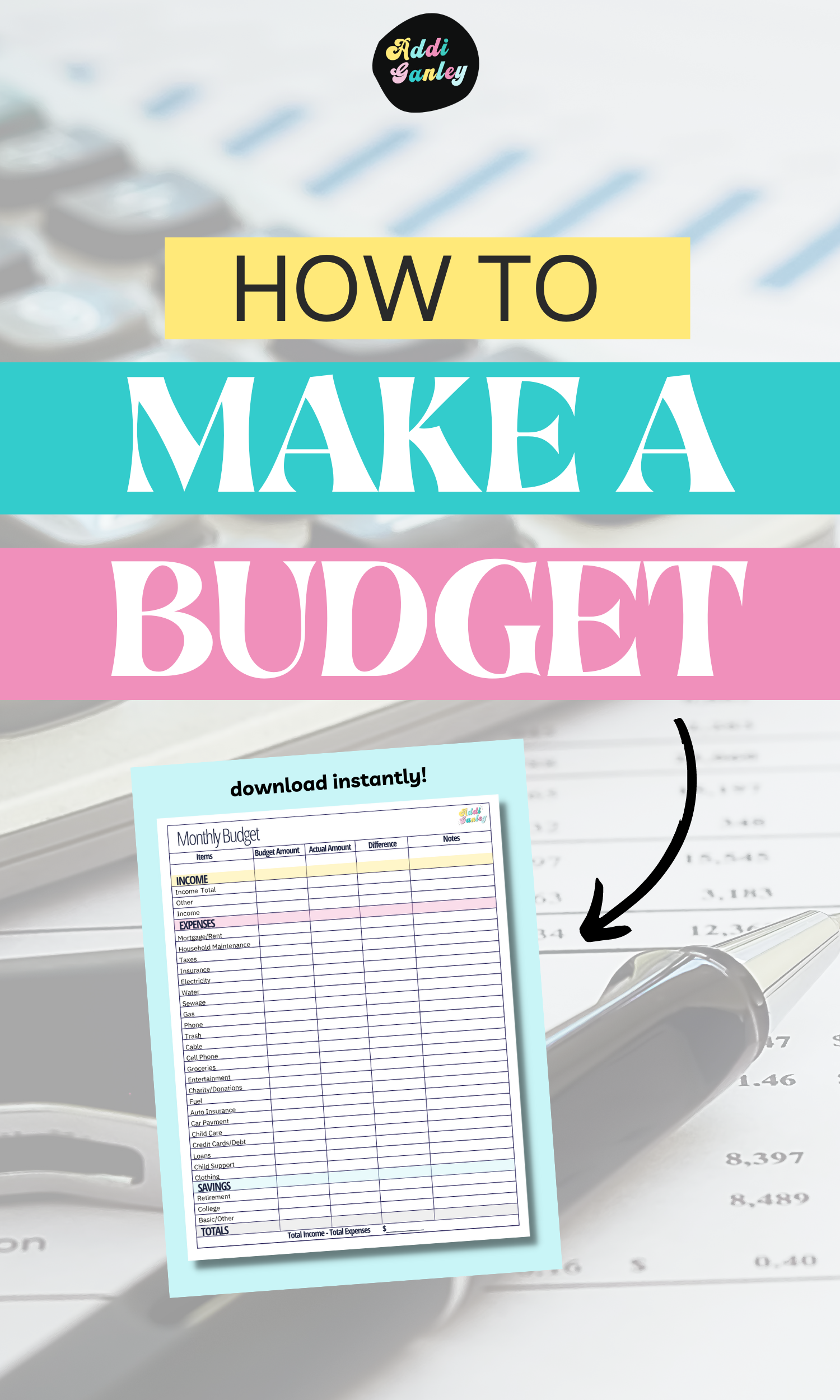

Below you will find out exactly how to make a budget as well as ways to help you save money. Plus, you can download my Free Monthly Budget Printable to get started right now.

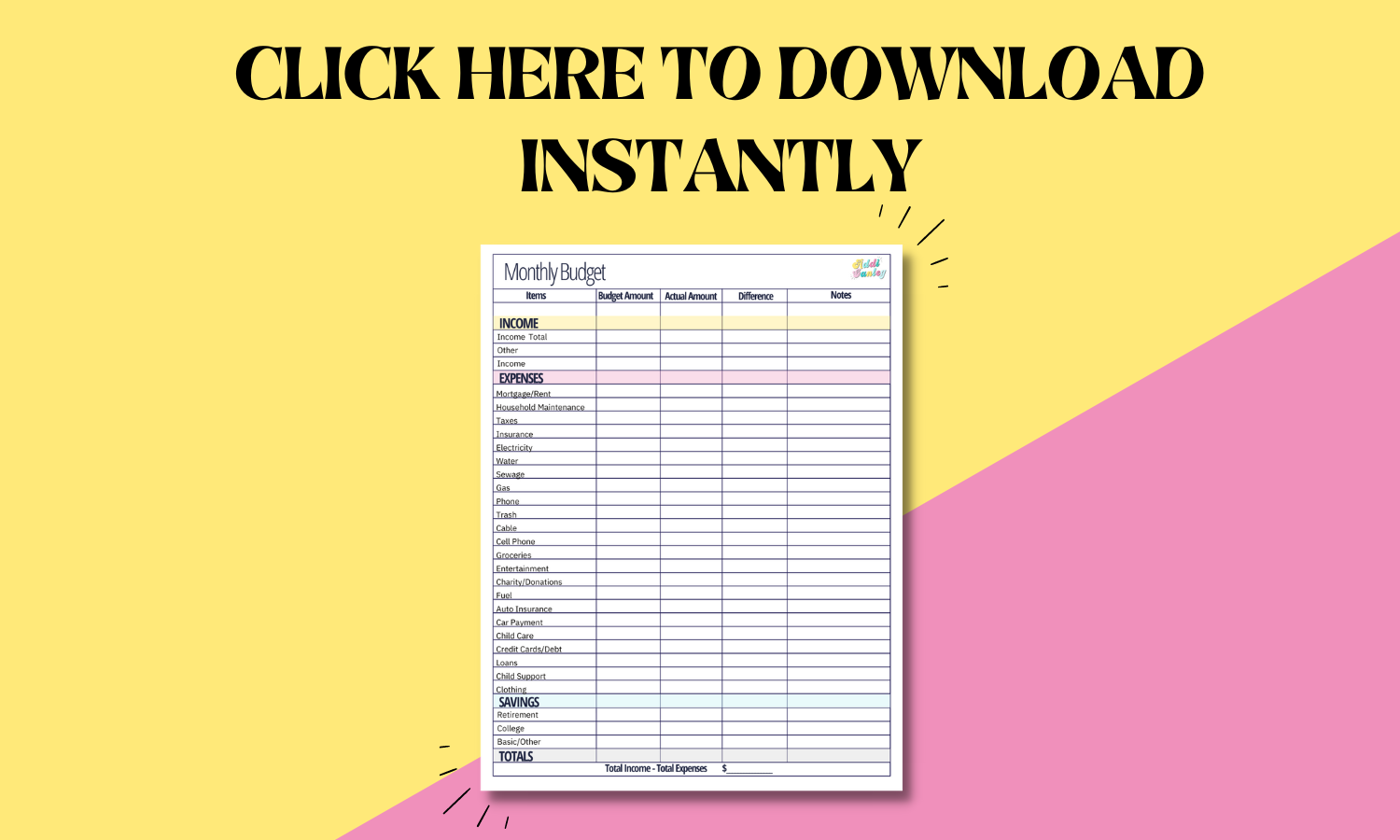

Click the image below to instantly download the Monthly Budget Worksheet. If you need help using the printable, you can check out this monthly budget template post here.

How to Make A Budget

You have to be willing to change your lifestyle before starting a budget. You will have to make changes and cut down on your expenses which means you need to commit to this process.

It definitely can be hard in the beginning, but don’t look at it like a restriction. It is just changing your habits and adjusting how you spend money so you can start to hit your financial goals.

Before you start to make a budget you need to understand that it takes time.

You will be tracking your spending. Literally, everything you spend money on needs to be tracked.

Trust me you will definitely see the rewards and benefits if you stick to it.

Getting Started with a Budget:

Keep track of all of your spending. You must write everything down. Honestly, you will be shocked when you see exactly where your money is going.

You will also need to keep your receipts so that you do not forget any of your expenses. Doing this will help you to learn what your ‘necessary expenses’ are in a given period of time.

Start by creating a list of necessary expenses. This will be the beginning framework of your budget.

This will allow you to focus on what you need to be spending your money on each month like bills, utilities, necessities, etc. This list will paint you a picture of how much are spending. You will be able to see what is left over each month to start to grow your savings.

Hopefully, you will be able to see that your income is more than your expenses. If not then you need to focus on other ways to cut back.

Categorizing your expenses will help you to stay on track too.

Here are some examples to write down.

Mortgage/Rent

Utilities

Credit Cards

Insurance

Car Payments

Groceries

Daily Expenses: Gasoline, parking, etc. {work purposes}

Child Care

Entertainment

To see the full list of examples check out our Monthly Budget Template post.

You can also add a few miscellaneous categories for charity and particular savings goals.

Once you can clearly see everything written down it is easier to find out what expenses you will need to cut back on.

Obviously, you cannot change your mortgage or other monthly payments, but maybe you can save on your groceries or entertainment.

I was able to see after using the printable that we spent too much money on entertainment.

For us this included, going out to dinner, casual shopping, movies, etc. This doesn’t mean we cannot do any of these things anymore it just meant we had to keep it to a minimum.

Tip: Give yourself a weekly allowance. This will allow you to stay within your means. The best way of doing this is by taking out a certain amount of cash so that you cannot go over your allotted amount.

This entire process is trial and error. You will find that some things will and will not work for you and your lifestyle. The best part of how to make a budget is that you can alter it to fit your family’s needs.

Once you get into the habit of tracking your expenses you can start to see how much you spend on each category. This will help you set a ‘budgeted’ amount for each category.

For example, if your water bill fluctuates between $50 - $65 each month you’ll want to make sure you budget $65 to be able to cover it on the high end. Then, when the bill comes in and it’s only $53 you have $12 leftover to either go into savings or pay towards one of your debts.

I know $12 doesn’t seem like a lot but every little bit helps.

The key is getting into the groove of tracking all of your income and expenses so that you can start to create a budget that fits your lifestyle.

You never want to force yourself on a very strict budget because it will just become stressful. Start small and ease into the process.

Budgeting allows you to spend money where you want to be spending it instead of just paying bills. You will need to be committed but it will pay off in the long run!

Here are some of my own personal budgeting tips:

Use cash - using only cash can really help you to prevent overspending because once the money is gone it is GONE. You cannot charge for something that you wanted to buy, you will have to wait. Using cash is a hard method to figure out but once you do you will be very happy with the results. This is one that I really struggle with and will be focusing on this year.

Shop smart - when I say shop smart I mean that you need to plan a grocery list and try to be strategic with your shopping. This may mean shopping sales, using coupons, buying in bulk or any other method that will help you to save money.

Track all of your expenses - having a budget in place will allow you to see exactly where you are spending your money and how you can cut back. You may not realize the amount of money that you are using on fast food or entertainment each month. A budget will help you to see where the majority of your money is going and you will learn ways to save that fit your lifestyle.

Comment below and share some of your budgeting tips and tricks.