6 Tips To Increase Your Savings

Are you trying to increase your savings? Whether you are saving for a special purchase or to build an emergency fund, it can be hard to be disciplined about saving that extra money. Here are some fun and effective ways to save some extra money.

6 Tips to Increase Your Savings

Finding money to save can be extremely difficult especially if you are living on a tight budget. There are always places that you can find to cut back to try to increase your savings. You must keep in mind that it is not something that will happen overnight. Saving money takes time, but it will pay off in the end. Below you will find 6 great tips to help you increase your savings.

Ways to Increase Your Savings:

Set a Goal

It is an important part of the saving process to set a goal for your savings. Even if you are looking to build an infinite emergency fund, set incremental goals that are achievable. Not only will this prevent you from getting discouraged but it will help you celebrate when each goal, no matter how big or small, is accomplished. You can also add what you are trying to save for. This will help you prevent using on something else because you will have a precise goal and need to save an exact amount to achieve it.

Automatic Savings

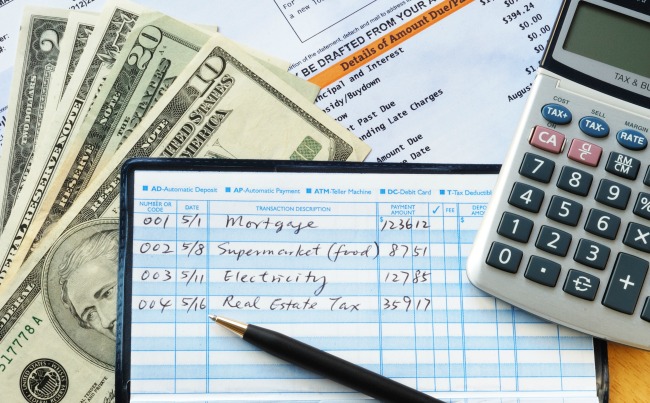

Consider setting up a separate savings account where you set up automatic deposits from your primary checking or direct deposit account. This savings account should be moderately difficult to access {no ATM card, for example} or limits should be set on daily withdrawals. This method reduces temptation to use the money you saved for splurges or sprees that you will inevitably regret afterwards. Depending on the ultimate intended usage for the saved money you should strive to strike a balance between accessibility and protecting your savings. Also consider a Keep the Change program where checking purchases are rounded up and the difference is deposited in your savings. This will increase your savings and making balancing your checkbook easier since many entries will be in nice, round numbers.

Tip Jar or Spare Change

Establishing a tip jar or spare change jar is fun way to watch money grow and to get the whole family involved. Have everyone bring home spare change found or from spending and put it in the jar at the end of the day. Make a big event out of bringing that change to the bank to be added to the savings account or even make a chart to help the little ones understand saving towards a goal. This is an awesome way to help teach your kids how to save money as well.

Accumulate Savings from Rewards Programs

If you participate in rewards programs such as gas points or cash back, try to take the savings that you realize and put that away in your account. For example, if you use credit card points to get an Amazon gift card and you save $25 on a diaper purchase, consider taking a portion of those savings and depositing them into your account. This will also help you to quantify the benefits you gain from rewards programs to determine which ones are the most profitable.

Watch your Paycheck Cycle

Depending on your pay cycle, you may get paid more times in certain months. For example, if you are paid bi-weekly on a Friday there will be some months that have five Fridays and therefore you might get paid three times in that month. If that is the case, look at your budget for the month and see if you can take a portion of each check for that month and put away one quarter to one half of that extra paycheck.

Choose your Savings Account Wisely

It is important to periodically evaluate where you have your savings and determine if you are making enough interest on that money. Here you need to balance access to money against any commitment to keep the money in the bank so that it earns interest. Typically the interest rate will be low but often the more money you have to deposit, the higher interest rate you can access.Having adequate savings is a key part of achieving and maintaining good financial health. Leave a comment if you have some unique or creative ways to increase savings.

Here are other Frugal Living Tips & Ways to Save Money

Save Money on your Monthly BillsFREE Monthly Budget TemplateCreating a BudgetEating Organic on a BudgetAlso, make sure you checkout the Frugal Fanatic Facebook page and follow us on Pinterest for DIY projects, recipes, money saving tips and more.

What methods do you use to increase your savings, please share in the comments below.