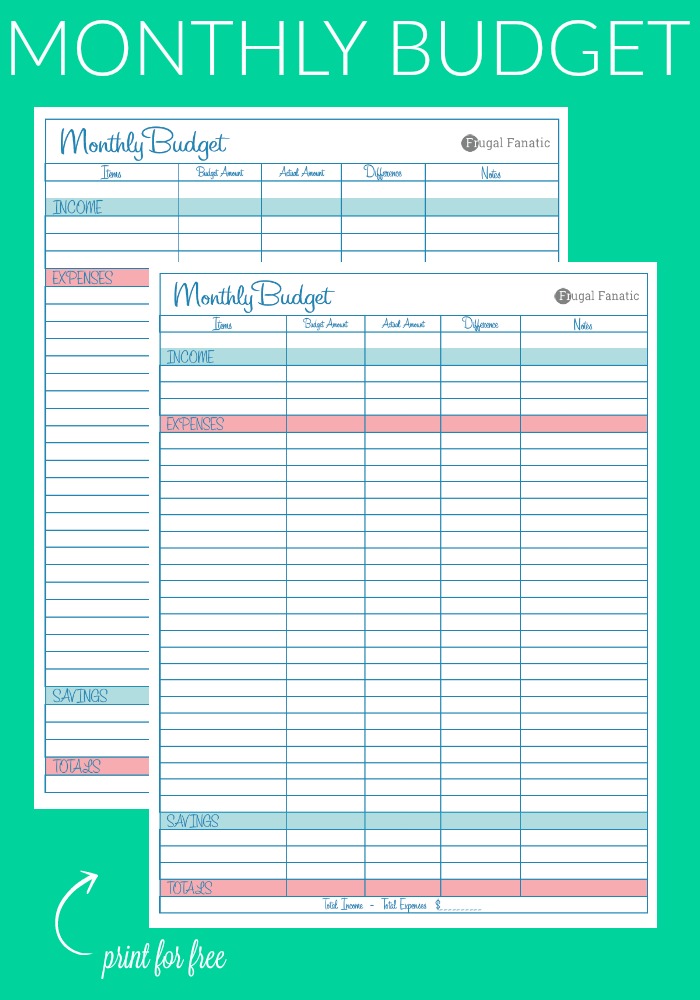

Blank Monthly Budget Worksheet

I talk a lot about budgeting on my blog because it is one of the best ways to save money.

A lot of people get scared off when they hear the word budget. They fear seeing where they are actually spending their money every month.

But, in order to learn new spending habits and cutback you have to see your income and expenses.Using a monthly budget can help you to do this.

Do not be scared of using a budget worksheet. To make it as easy as possible for you I am sharing with you a blank monthly budget worksheet so that you can fill it out with your own expense categories.

Get this AWESOME freebie now!

Subscribe to get access to this freebie and our entire resource library filled with worksheets & downloads to budget and save money!

Don't forget to add in any extra income you make aside from your normal paycheck. One of the number one struggles that I hear from all of you is sticking to a budget.

I am definitely guilty of starting off great and then slowly getting forgetting about it and not holding myself accountable.

Then, at the end of the month, I think to myself, "Where did all of my money go?" Seeing our bank statement helps me to quickly get back on track.

Need help saving money? Use this free blank monthly budget worksheet to help you find new ways to save money and cutback on your spending. Did I mention it's free!

{Related: Mistakes People Make Budgeting}If you think using a simple budget may not be enough then I recommend you take a look at my Yearly Household Budget.

It is an interactive excel spreadsheet that automatically calculates your totals and allows you to view where you are spending the majority of your income. It includes a monthly budget, yearly summary and an expense summary. It is an EASY way to gain control of your finances

Sticking to a budget is difficult. You need to understand that it is all trial and error. You need to learn where you are spending your money to figure out how you can cut down on those expenses. By writing down your expenses you can see which categories are too high. For example, you may start to see that you spend way too much on food costs. In that case, you will need to be proactive to lower those expenses.

Whether it is through meal planning, using coupons, cutting back on dining out or anything else you are able to do to lower that category.

Using a monthly budget will allow you to see how and where you need to change your spending habits. But, do not just stop there. You want to learn how to increase your savings account too.

Related: Using the Envelope System and Pay Yourself First

Once you get your finances under control you will be able to start to build your savings account. Using a monthly budget is step one in this savings journey.