How to Budget and Save Money in the New Year

Can you believe we are about to ring in the new year? This means a fresh start and a new set of resolutions. Why not make this the year you get your finances in order.

Today, I wanted to share with you how to budget and save money in the new year. It may not be as difficult as you think.

Many people hear the word budget and scared off. They think it’s too much work. I want to share with you some easy budgeting tips for the new year that will help you get started off on the right foot.

It does not have to be hard.

Want to gain control of your finances and finally start to have money in a savings account? Check out these tips on how to budget and save money in the new year! Click now to read...

Once you get a system you will see that it becomes a part of your routine.

Even though it will still be challenging, the reward of using a budget is far greater than the challenge.

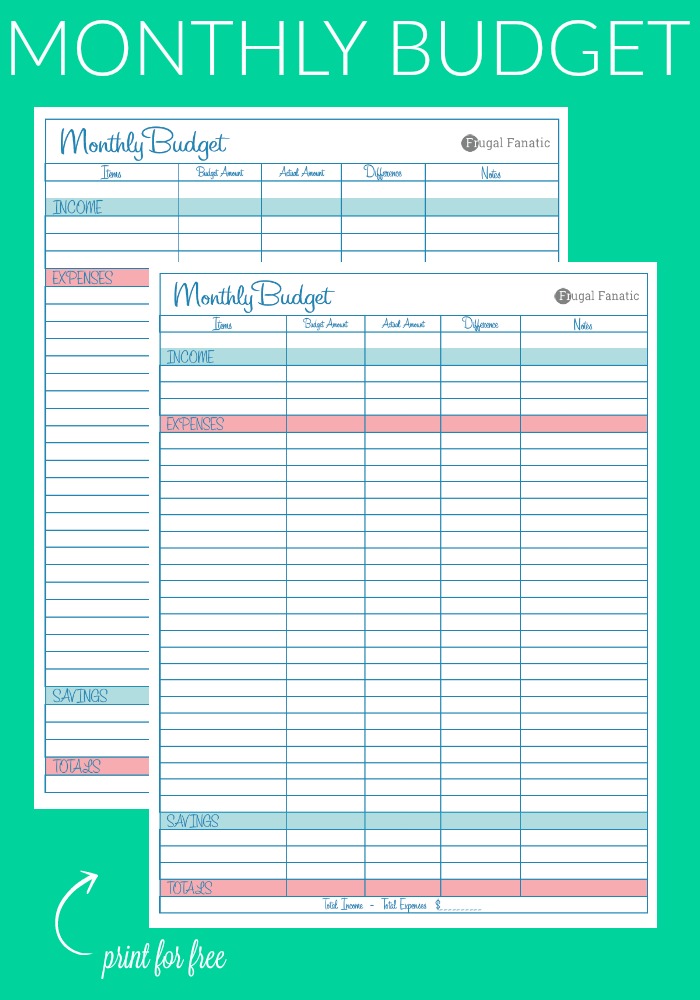

If you do not have a budget in place you can print my free budget worksheet to help you get started. It will allow you to put in your monthly income and expenses.

Taking this first step is HUGE. Making the decision to finally gain control of your finances this year is a decision you will thanking yourself for later on.

How to Budget and Save Money:

Want to gain control of your finances and finally start to have money in a savings account? Check out these tips on how to budget and save money in the new year! Click now to read...

Update your Budget

Often, as we start a new year, there are changes to our monthly earning and spending. Though the changes may be minimal (such as new paycheck figures once taxes for the new year begin) it is no less important to account for them in your budget. By reviewing your figures and adjusting them to make sure that they reflect your income and needs, you’re making sure that your budget continues to run efficiently.

Resolve to Pay Down Debt

Debt, in all of its forms, isn’t necessarily a bad thing. Mortgage debt, car loan debt, etc. are often part of life and, when paid on time, can lead to a positive credit rating. Where debt can get bad is when you purchase what you are unable to pay for and accumulate credit card debt (with interest.)

First, make a resolution to pay down (or off) any credit card debt that you may have and then work to get yourself in the habit of only buying what you can afford at that time (and paying it off each month.)I know this is a HUGE thing to do. No matter how large your debt may be the important part is working towards paying it off. Often times people say, “It doesn’t matter because I will never be out of debt.”

This is the wrong mindset to have. You can get out of debt but you have to work towards it by making sacrifices and cutting back when you can. Be sure to print out my debt payoff worksheet to help you visualize your debt and start to pay it off.

Make Savings Goals

Having a savings account is a very important part of budgeting. It makes for a cushion when those unexpected expenses (such as car repairs or home appliance replacement) occur. By having money left untouched in a savings account, you can watch it grow and know that it is there when you need it.

For the New Year take a look at your current account (or open a savings account.) Make a goal for where you would like to see those figures at the end of the year.

As the year goes on, put as much as you can into that account and watch it grow. The added security it brings will help you to feel more at ease when those inevitable expenses arise.

You can then break your goal down into monthly increments or even weekly amounts. This will help you learn to see how much money you need to put away monthly to reach your yearly savings goals.

An easy system to start building your emergency fund is by utilizing the concept of paying yourself first. You can read all the details about how you can get started and begin to build your account.

Plan for the Future

The closer that we get to retirement, the more we think about the finances that we will have available when we get there. Whether you are 20 or 50, planning for your future will help to ensure that you have the ability to enjoy your retirement years

Working with a financial planner to set up a series of investments will help you to be in a good place when those years arrive. If you haven’t thought about how to make sure you’ll be ready, make this the year that you’ll give it some thought and figure out (with the help of a professional) your best course of action.

Keep on Top of it All

This one is definitely easier said than done. When the laundry needs to be folded and dinner needs to be made, it may be difficult to carve out time for working over your budget. Setting aside the same time each week (before the kids are awake or after bedtime may be best) to work on your figures will help you to be sure that you’re on track.

Track your expenditures as well as your savings on a regular basis to be sure that you are staying within the figures that you’ve set. By keeping on top of it, it will run more smoothly and will make for less time spent on each budgeting session.

An easy way to do this is with my free budget binder worksheets. They will help to keep you organized and on track. Once you start using it you will begin to make time to sit down and track your income and expenses. Whether it is on a weekly basis or bi-weekly basis, staying on top of it will help you to save more money.

With careful planning and budgeting, the New Year can be a great one for your family. If you are unsure where or how to start I recommend beginning with a simple monthly budget. Just seeing everything down on paper will help you to see where you are spending your money each month.

Once you know how you are spending your money you can start to come up with a plan to cut back and learn new ways to save money.

Do you have other tips on how to budget and save money for the new year?